The Cloud Hanging Over Trudeau

Justin Trudeau is young and attractive. The gossip site E! Online once even gushed that he is a "beautiful, sticky-sweet specimen." This ex-pot smoker, ex-bouncer and ex-backbencher in parliament ran for election for his country’s highest office a few years back pledging to make Canada more modern and tolerant. He had so much in common with former United States President Barack Obama that many called him the "Canadian Obama." Many had, or continue to have, high hopes for the two politicians, particularly younger voters, and both promised in their campaigns to deliver a better and, above all, fairer future.

Trudeau won parliamentary elections in 2015 running on the slogan “Real Change.” He promised to break with an old system of politics that had been custom-tailored to the interests of elites, to increase taxes on the rich and to wage war on tax havens. Trudeau has repeated those goals several times since becoming prime minister. In 2016, Trudeau said he had been elected in part because he promised everyone would be “paying their fair share of taxes” in the future. “The level of awareness that citizens of the world are beginning to take in regard to tax avoidance and evasion is a good thing,” he said, “but it’s certainly something we will be working on together as a community of nations.”

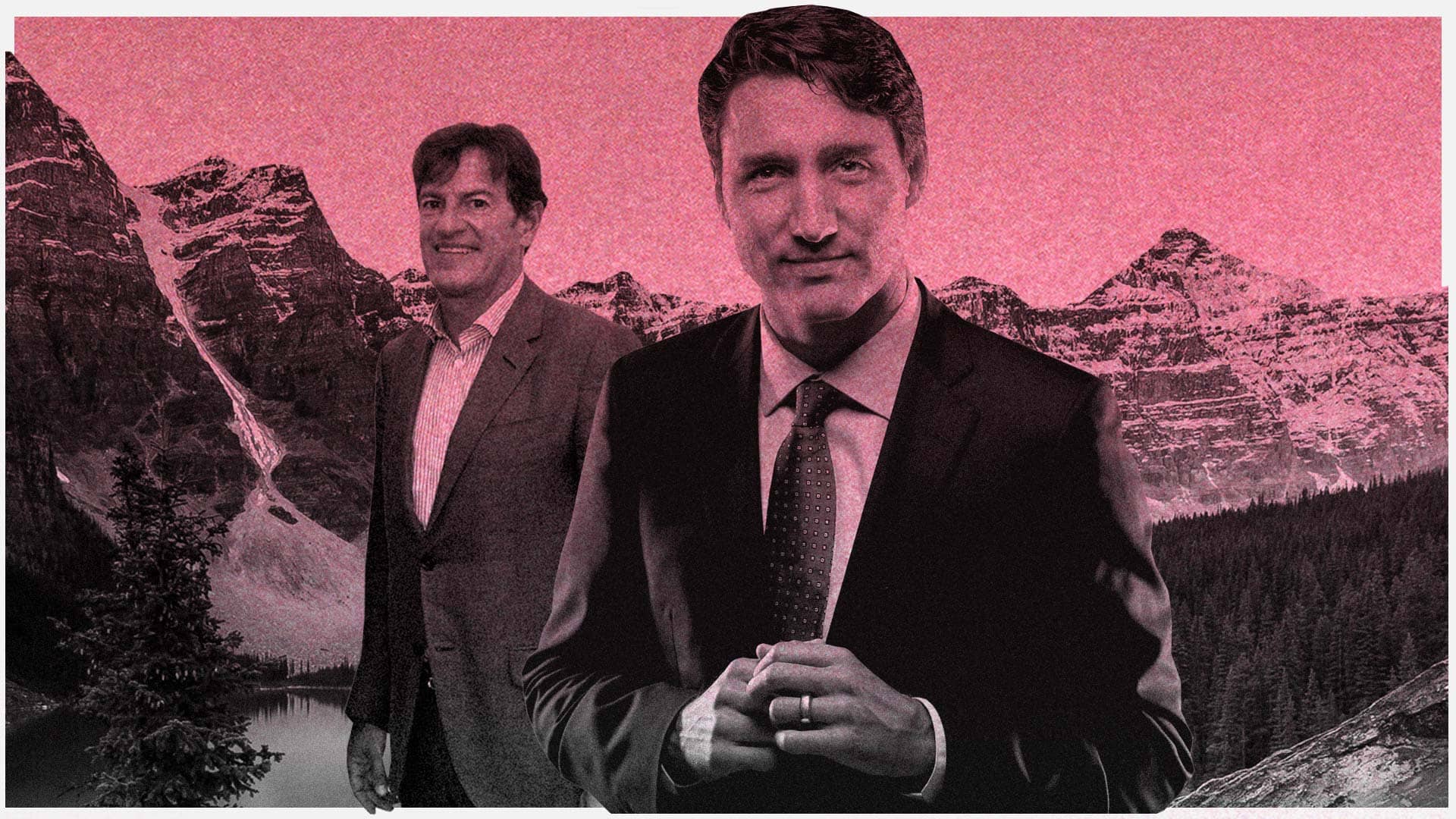

The Paradise Papers, however, raise suspicions that one of Trudeau’s closest party allies, a man who counts among the prime minister's most ardent supporters, is involved in a tax avoidance scheme. That confidant is Stephen Bronfman, who has been friends with Trudeau for years. A businessman from Montreal, Bronfman comes from one of Canada’s richest families, which earned its fortune through real estate and other dealings. Like his father Charles, Bronfman has been successful in the business world, influential on the political stage and active as a philanthropist.

Trudeau’s political rise is tightly linked to Bronfman. When Trudeau first set out to become the leader of the Liberal Party in 2013, he asked Bronfman to help out with fundraising. And when Trudeau successfully landed the position, he put Bronfman in charge of filling the party’s war chest. In 2014, he raised more money than the party had in years, an effort that helped secure Trudeau’s victory as the country’s next prime minister. A short time later, when Trudeau traveled to Washington to meet with Obama, Bronfman also accompanied him. As its chief fundraiser, Bronfman remains a major Liberal Party force today.

The Paradise Papers raise the question: Was the financial behavior exhibited by Bronfman, now a member of the national board of the Liberal Party, always consistent with the young Canadian prime minister’s political agenda? The documents indicate that over a period of decades, Stephen Bronfman and his father have transferred at least $34 million to a mysterious trust located on the Cayman Islands. Furthermore, Stephen Bronfman’s investment company Claridge Inc. was, at least for a time, involved in the supervision of the trust assets. Internal documents suggest taxes may even have been evaded.

According to reporting conducted by Canadian public broadcaster CBC, the Toronto Star newspaper and the Süddeutsche Zeitung, the name of the entity at the center of this story is Kolber Trust, named after Leo Kolber, a former Liberal Party senator. Kolber was extremely influential in Canada for years and also had close ties with the Bronfmans. At times he managed the family’s assets, served the family as an adviser and also became Stephen Bronfman’s godfather. The trust that bears his name is located on the island of Grand Cayman. Founded in 1991, its legal structure resembles that of a foundation. According to the certificate of incorporation, Leo Kolber has decision-making capacity, but the beneficiary from the very beginning was his son Jonathan. The Paradise Papers show that money for the trust came from his close friends, the Bronfmans, among other sources. Charles Bronfman once provided a $9 million loan and Stephen Bronfman later lent the trust $5 million.

It’s not entirely clear why the Bronfmans would provide their friend Kolber and his family with access to so much money. Over time, it appears the two families’ finances became increasingly intertwined. For a time, Jonathan Kolber also ran a branch of the investment firm Claridge, which the Bronfmans established in Israel in the early 1990s.

Given that tax fairness and closing loopholes, especially those that benefit the rich, is the stated goal of Trudeau’s left-leaning government, the creation and financing of the Kolber Trust is awkward to say the least. If one of the prime minister's closest confidants, who also happens to be a party official, has been using the system of subterfuge offered by trusts and tax havens, it would be indicative of exactly the kind of double standard that Canadian voters are fed up with. When asked to comment, a lawyer representing Jonathan Kolber said, “none of the transactions or entities at issue were effected or established to evade or even avoid taxation.” He added they “were always in full conformity with all applicable laws and requirements.” Bronfman himself did not comment.

Andrew Vaughan/The Canadian Press/AP

The Paradise Papers nevertheless shed light on a plethora of details that make the Kolber Trust appear shady indeed. For one, the documents show that the parties involved often provided loans with no interest. These types of loans attract the attention of tax investigators because they are often used to conceal income or gifts by cloaking them in the form of loans to sneak them past the fiscal authorities. In 2004, for example, Jonathan Kolber, the beneficiary of the Kolber Trust, received an email from his financial adviser telling him that two of the Bronfmans’ trusts had to charge him interest on loans for legal reasons. But, he added, the Bronfman firm Claridge would compensate him (“make you whole somehow”). One possibility mentioned was that he could invoice Claridge for services rendered equal to the interest charged. The next year, meanwhile, an email sent to Jonathan Kolber said “there was never supposed to be interest paid on this debt in substance (only in form).” Zero-interest loans, fake invoices – if tax investigators were going to find anything suspicious, it would be here. Jonathan Kolber's lawyer responded to a request for comment by saying non-interest bearing loans were permitted “in certain circumstances.”

A further indication of tax avoidance can also be found in the Paradise Papers. By 2007 at the latest, Jonathan's sister Lynne had joined him as a beneficiary of the Kolber Trust. Lynne lives in the U.S. and is therefore required to pay any taxes due on revenue from the trust there. A note in an Appleby file dating from 2007 states that Lynne should thus be supported “in other ways.” It suggests, for example, that her brother Jonathan could give her money as “gifts,” since these would not be subject to taxation in the U.S. Kolber's lawyer insisted that after 2006 "no gifts were made by Jonathan Kolber to Lynne Kolber Halliday and no distributions were made to her from the Kolber Trust."

CBC and the Toronto Star showed the documents in question to a number of respected tax experts. After reviewing the documents, Grayson McCouch, a tax expert and law professor at the University of Florida, said, “I would say there are lots of red flags and I would expect tax authorities specifically to be very interested in following up.” The lawyer representing Jonathan Kolber said there was nothing to the suggestion that his client had provided his sister with gifts.

A number of high-ranking politicians with Canada’s Liberal Party make appearances in the Paradise Papers, along with their companies. Prior to his time as the country’s prime minister from 2003 to 2006, Paul Martin was the owner of CSL Group, which had a registered subsidiary in Bermuda. When Martin became prime minister, he transferred the company to his children, who then registered a dozen additional companies in Bermuda. Documents also indicate that Jean Chrétien, prime minister from 1993 to 2003, had options in Madagascar Oil Limited, a company registered in the tax haven Mauritius. When questioned about the document, Chrétien said he had never held any options and that he had never been sent any documents or annual reports.

The Paradise Papers do not cast a positive light on the Liberal Party. It was Chrétien’s government, after all, that first worked on a law in the late 1990s aimed at tougher action against trusts and wealthy tax dodgers, but it eventually withdrew the draft law under pressure from lobbyists. It’s likely the law would have covered the kind of trust structure that former Liberal Party Sen. Leo Kolber and the party’s current fundraiser, Stephen Bronfman, either ordered or helped manage. It’s interesting to note that one of the lawyers who was active in opposing the law that would have cracked down on trusts also represented the Bronfman trusts. While the Bronfmans made a left-leaning impression, they appear to have been more concerned about their own wealth.

Laws weren't tightened until after the Liberal Party was voted out of office in 2007. New legislation called for the taxation of money transferred from Canada to offshore trusts. It also appears that the Kolber Trust, which regularly received money sent from Canada – in 1995, for example, when Stephen Bronfman issued an interest-free $5 million loan to the trust – may have been covered by the new law. Advisers to the Kolber Trust quickly decided to restructure. In 2007, they founded the Lacombe Trust, a new structure on the Cayman Islands. The trust’s official founder was the offshore services company Appleby, but Sen. Leo Kolber maintained the right to choose the beneficiaries at any time. This thick layer of secrecy, which shrouded Kolber's involvement behind Appleby, may have been used to circumvent the stricter new laws. Indeed, leaked documents seem to suggest this was the case. "The Lacombe Trust was settled by the Kolber Trust so that the tax questions that arise or may arise in Kolber should not surface in Lacombe," a memo in the Paradise Papers read. Shortly after the new construct was established, $23 million was transferred from the Kolber Trust to the Lacombe Trust.

Prime Minister Trudeau chose not to comment on the matter when contacted. But the revelations could leave him with some explaining to do. They show that one of his closest party allies is dabbling in the very same tax tricks that Trudeau himself lashed out against during the election campaign.